People who are hurt or become ill on the job in South Carolina often face a number of challenges, including paying for medical treatment and supporting themselves and their families while they are unable to work.

South Carolina law generally requires that all employers with four or more workers have workers’ compensation insurance to pay for medical care, a portion of lost wages, and other benefits for full-time and part-time employees injured on the job. The purpose of workers’ compensation insurance is to protect employees.

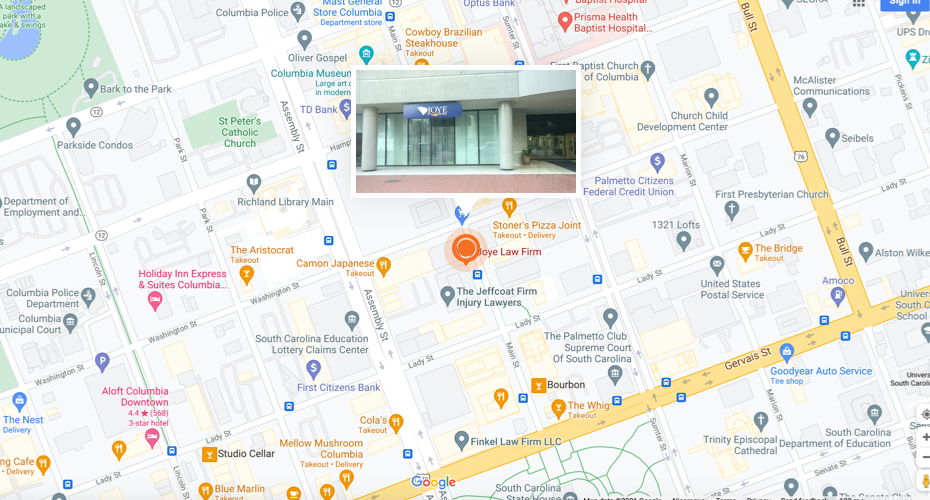

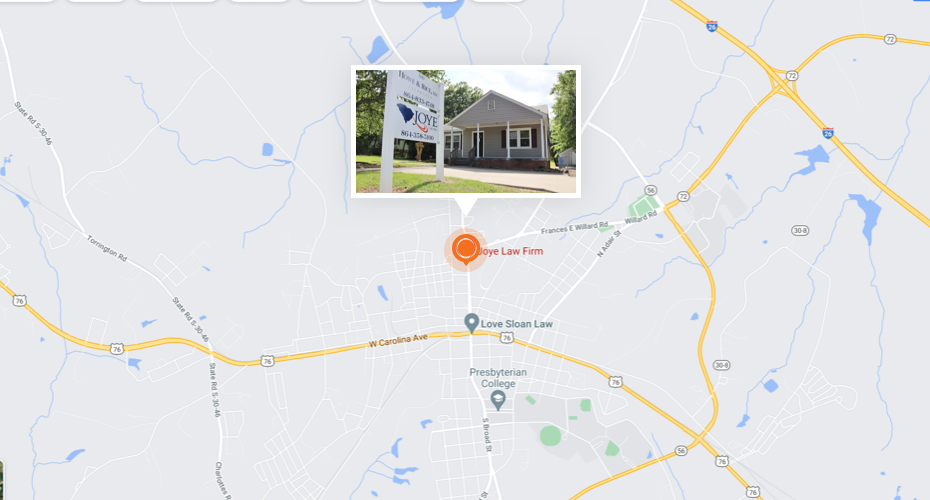

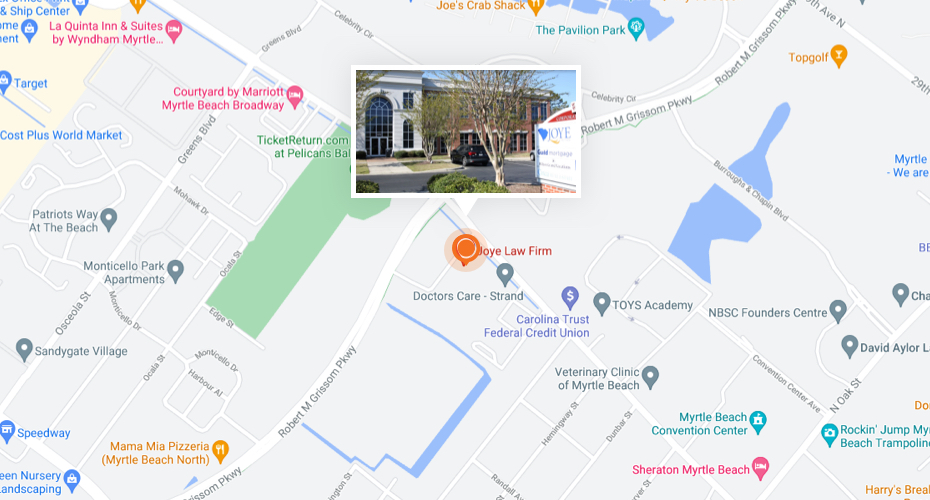

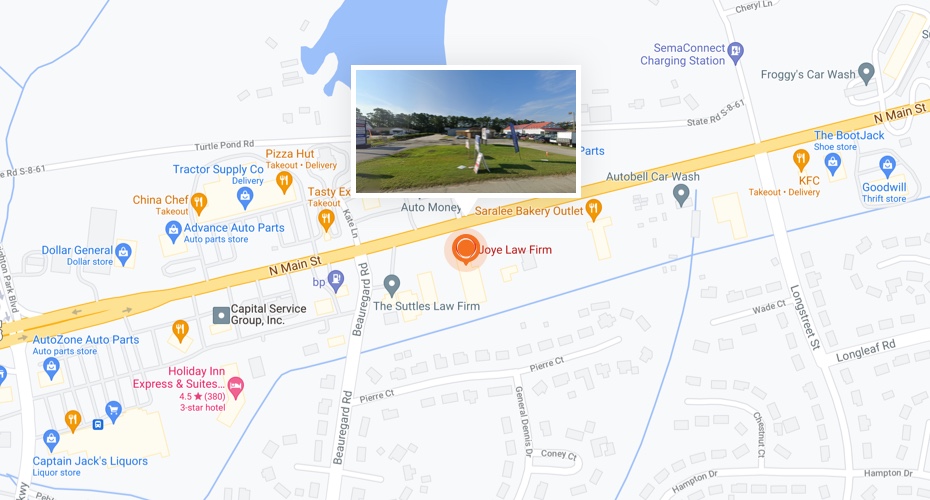

If you suffered serious injuries or your loved one was killed on the job in South Carolina, it is important to understand your legal rights and the workers’ comp benefits available to you. If your employer or the workers’ comp administrator disputes your right to benefits, you do not have to try to handle the issue on your own. South Carolina’s workers’ compensation system has complicated rules and appeal procedures. A knowledgeable workers’ compensation attorney at Joye Law Firm may be able to help you pursue the benefits afforded to injured employees. Joye Law Firm has proudly represented injured workers in South Carolina since 1968. For help pursuing the benefits you deserve, call us at (843) 324-3100 or contact us online to arrange a free consultation.

What are South Carolina Workers’ Comp Benefits?

After an injury on the job, you are entitled to coverage of all necessary medical treatment. Workers’ compensation covers the costs of things like surgery, hospitalization, medical supplies, prosthetic devices, and prescriptions. Since workers’ comp is covering the costs, you are required to receive medical treatment from a doctor selected by the employer or the insurance administrator.

Workers who sustain severe injuries on the job may have to miss weeks or months of work or be unable to return to work. An injured worker may qualify for temporary compensation to recover part of their lost wages and receive permanent disability benefits if he or she sustained permanent injury.

There is a seven-day waiting period before workers’ compensation benefits can be paid, but an individual will be compensated for the original seven days if he or she is out of work for more than 14 days. The payments will be sent directly to the injured worker. When a doctor clears a patient to return to work, worker’s compensation will be stopped. The individual will have to request a hearing if they disagree and cannot perform the work assigned to them.

Temporary Total Disability Benefits

If you suffer a work-related injury or illness that causes you to be completely disabled and unable to work for a specific period of time, you may be compensated for lost wages at a rate of 2/3 of your average weekly wage. The method of calculating your average weekly wage is specified in South Carolina’s code of laws in Title 42 and involves looking at the four quarters before your work-related injury occurred. If a person was working two or more jobs at the time of an accident, those multiple sets of wages can be included as part of the average weekly wage and compensation rate.

However, there is a cap on the compensation you can receive. As of 2023, the maximum weekly compensation for those who were temporarily totally disabled is $1,035.78. Many times, insurance carriers underestimate an injured worker’s average weekly wage by failing to take into consideration overtime wages and bonus payments.

These types of benefits are meant to last only until you have recovered to the maximum degree you can. Ideally, you’ll be able to return to work at this point, but if you can’t, then your benefits will continue until you have reached maximum medical improvement (MMI). After 150 days have passed since the work accident that caused your injury, your employer’s insurer cannot unilaterally terminate your weekly benefits, but it is able to request a hearing to terminate your temporary total disability benefits.

Temporary Partial Disability

Many workers are unaware of the existence of temporary partial disability benefits and, as a result, many who would be entitled to these benefits never claim them. Don’t be one of those people. If you suffer an injury that restricts you from performing some work duties or tasks, you may qualify for temporary partial disability benefits if your income is reduced as a result. For example, you may be given reduced work hours as a result of being unable to perform certain tasks, or you may even be reassigned to a different and lower-paying job while your injury heals. If this occurs, then the difference between what you make while partially disabled and what you were making before your work injury should be paid.

Under South Carolina law, your temporary partial disability benefits are calculated by taking 2/3 of the difference between your current wages while on restricted or light duty and your average weekly gross wages before the injury. For example, if you were making $900 before you were injured and $500 per week while partially disabled, the difference between your pre-injury wages and your light-duty wages is $400. You would receive temporary partial disability benefits equal to 2/3 of this amount.

Permanent Partial Disability Benefits

In some cases, an injury that causes a partial disability will never completely go away, and your earning power may be permanently reduced as a result. For instance, if you were working in a labor-intensive job such as those in construction, you may not be able to continue doing this work. Although you might not be totally disabled and you could get a job elsewhere or doing something else, your income might be permanently lower as a result. If this is the case, then you could receive benefits for permanent partial disability.

Many workers are not aware that these types of benefits exist since insurance companies and their lawyers aren’t going to voluntarily offer these benefits to you or even inform you about them. As such, it is important that you have your own lawyer assisting you as you settle your workers’ compensation claim.

In many cases, the compensation you will receive for permanent partial disability can be significantly better. Your compensation will be determined based on reports from medical professionals as well as testimony about the impact of your medical condition on your livelihood, so it is important to have a certified vocational consultant evaluate you. Your lawyer can help you find a consultant.

Scheduled Member Disability Benefits

If you suffer certain types of permanent injuries, such as the loss of a limb, then you are entitled to a specific payment based on the severity of your injury as rated by a physician. The rating given by your doctor is called your “impairment rating.” Your employer can choose the doctor who assigns your impairment rating, and many employees wrongly believe that they must accept what this physician says and not seek a second opinion. If you have a workers’ compensation attorney, your lawyer may be able to arrange an independent medical examination to have a third-party specialist evaluate the severity of your injury and provide an opinion on an impairment rating. Getting a second opinion from a doctor may significantly improve the final amount of compensation you receive from workers’ compensation.

Total and Permanent Disability Benefits

If the effect of your injuries is such that no reasonably stable job market exists for you, then you may be considered totally and permanently disabled and entitled to permanent disability benefits. There are a host of factors that are considered in determining if a reasonably stable job market exists, including the nature of your injury, any permanent physical restrictions, your age, your educational background, your work history, and even the state of the economy in your locality.

In cases involving a claim for total and permanent disability, an experienced workers’ compensation lawyer will coordinate an evaluation of you by a vocational consultant to address these factors. Typically, the amount of benefits you will receive is limited to the equivalent of 500 weeks of benefits, except in cases where you have suffered a physical brain injury or where you have become a paraplegic, quadriplegic, or otherwise paralyzed. In these special cases, you may be entitled to receive lifetime benefits.

The South Carolina Supreme Court has ruled that partial paralysis qualifies as paraplegia under our law, entitling the injured worker to lifetime benefits. Whenever you believe you have suffered an ongoing and permanent disability that makes you completely unable to work, it is imperative you get legal help. Your case may be worth thousands or even hundreds of thousands of dollars over your lifetime, and you should consult with a lawyer to make sure you get the full amount you deserve.